This article was originally published at bitcoinmagazine.

One of the most fascinating aspects of bitcoin is its historically meteoric price rise. Is bitcoin going to continue on this historical path, or is growth going to slow or even halt?

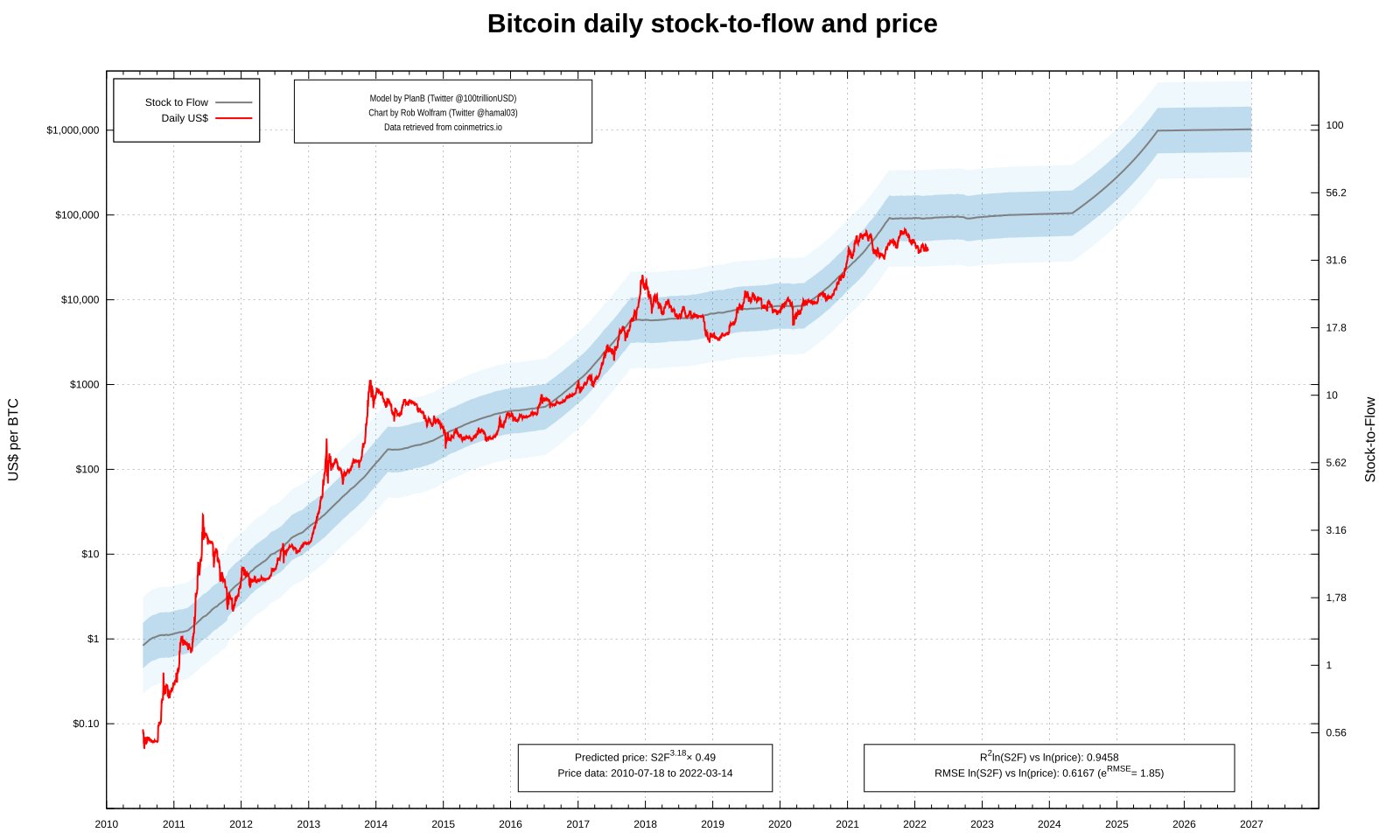

The S2F model, put forward by PlanB, suggests that bitcoin’s future price can be forecast roughly, and that the price will continue a steady and impressive path upwards, with approximately ten-fold returns every four years. The S2F model has attracted a lot of attention, and PlanB has amassed an impressive number of followers (1.7 million at the time of writing).

Perhaps in part due to its popularity, the model has more recently been met with a lot of criticism. An example of such criticism is a harshly worded recent article published in bitcoinmagazine . Already in July 2020, Eric Wall put together a collection of criticisms.

It appears that most people find themselves in either of two camps: The “pro” S2F and the “con” S2F camps. How should we position ourselves?

Before I go on: I have written negatively about the S2F model since 2019, when I predicted that the S2F model’s predictions would prove too bullish. I have also exchanged with PlanB both publicly on Twitter (e.g. here), and privately. I have co-authored a more mathematical article together with InTheLoop, clarifying why we both think the S2F model is too bullish. It might therefore come as no surprise that I am not exactly in the S2F camp. However, I have noticed that some criticism towards the S2F is invalid. Other criticisms purport to deal a death blow to the S2F model, whereas in fact, they do not. I therefore hope to add some clarity. It is important to be right for the right reasons, because correct principles are our only chance of being right in the future.

The S2F model states that the price of bitcoin is driven by its scarcity. As the halvings ensure that bitcoin becomes ever more scarce, its price should continuously increase. The relation between scarcity and price is mathematically defined (using two empirically estimated parameters) and roughly forecasts a ten-fold increase in price every four years. This gives us a price of $100 000 per bitcoin for this halving epoch, $1 000 000 for the next, etc.

What’s wrong with this model? Let’s look at some arguments that are put forward to discredit the model.

Level39, the author of a recent bitcoinmagazine article had this to say regarding the S2F model:

Notice how the function says “market value” equals a function of Stock-to-Flow? This is a model misspecification with tautological logic and therefore statistically invalid, for the simple reason that “market value” decomposes to “Stock * Price” while “Stock / Flow” is on the other side of the equation. In layman’s terms PlanB is essentially asserting that “Stock is a function of Stock.” A tautology is a trivial statement that is true under any circumstances. It’s like saying a banana is a kind of banana. Of course Stock is a function of Stock. This is why the data fits, but is scientifically worthless. Tautologies are true but do not tell us anything useful. Rather, they are true because of the meanings of the terms.

But is this really so? Has PlanB really given us a tautological formulation that doesn’t tell us anything useful, a bit as if Isaac Newton had told us that F=F? Is stock really on both sides of the equation?

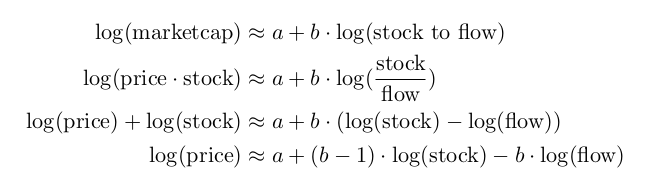

The S2F model as formulated by PlanB attempts to approximate the market cap of bitcoin using stock-to-flow as an input variable (where a higher stock-to-flow indicates higher scarcity). Two parameters (a and b) must be empirically estimated so as to get the best fit. Writing this down, it at first might appear that indeed stock appears on both sides of the equation (see lines 2 and 3). However, by simply rearranging terms, we see that this is fine: the price of bitcoin is on the left-hand side of the question, stock and flow on the right side.

We have clearly demonstrated that the S2F model is not afflicted by a tautology that renders it mathematically invalid. Still, there is one more point to make. Level39 goes on to explain:

PlanB could avoid the tautology by having price alone on one side of the equation and perhaps build a regression of price on flow or stock to flow, but the fit would be different without changing the parameters

In other words, if PlanB had attempted to model (the log of) the price using a linear function of stock to flow instead of the market cap, the stock would not appear on both sides of the equation, and hence the supposed tautology would disappear. In other words: in order to get a price forecast based on stock-to-flow, we could either

Level39 insinuates that 1. would produce a much better fit than 2. because of the supposed tautology. But is this really the case? In the below plot I have compared both models.

We see the two models are extremely similar to each other. There is no enormous difference in the quality of fit between the two models. Hence, even if there were a tautology in the original S2F formulation (there isn’t), the point would be quite trivial, since it would not materially matter. The model could be re-written to approximate price instead of market cap and the result would be almost identical.

Hence, the whole argument regarding a tautology is clearly moot. No death blow to the S2F model here.

Another argument against the S2F model I have frequently heard is also mentioned by Level39:

The other problem is that the model is autocorrelated, where the results of today’s value is a function of yesterday’s value. When you adjust for that, the R-Squared (R2) value is zero. Thus, scientifically speaking, Stock-to-Flow is nonsensical and cannot be used to model price.

Another way of stating this is to say that instead of trying to find a relation between stock-to-flow and price (or market cap) one should instead try to find a relation between changes in stock-to-flow and changes in price (or market cap). The claim is that changes in stock-to-flow on a day to day basis do not appear to cause a change in price on the same time scale, and hence there supposedly can’t be a causal relationship between stock-to-flow and price, meaning that the S2F model must be incorrect.

But is this really the case? Large changes in stock-to-flow happen only once every four years. The variations in stock-to-flow between the halvings are mostly small and have a strong element of randomness. Must we really expect that both small and large changes in stock-to-flow cause a change in price? This would mean that we are assuming that there is a linear response, which need not necessarily be the case: It could be argued that only large changes in stock-to-flow are meaningful.

Hence, the argument of auto-correlations also does not yield a death blow to the S2F model.

Another argument against the S2F model I frequently encounter is PlanB’s behavior on Twitter. Level39 has this to say about it:

[… ] anyone who points out a flaw, potential problem, has a valid question or even “Likes” a valid inquiry into the validity of his assertions is blocked [by PlanB] […] If PlanB wants to honestly claim that his models have a scientific R2 value in the high 90s, then he cannot be blocking and censoring valid criticism that shows otherwise.

The answer I have to this is that PlanB can do whatever he feels like on Twitter. He is not obliged to behave in a specific way or to answer any particular questions. His behavior has no impact on whether the S2F model is valid or not.

In addition to this, my own experience with PlanB has been very different than the one described by Level39. I have openly criticized his model on Twitter in 2019 (you can witness such a discussion here), and have not been blocked. We have exchanged privately, and I cannot characterize PlanB’s behavior as anything other than very friendly.

I have heard of events when people were blocked by PlanB, but I am not surprised by this: He has to manage an audience of 1.7 million people, which cannot be easy. In any event the ad hominem argument says nothing about the validity of the S2F model and should be disregarded.

There has been a long debate regarding whether a certain property known as cointegration (pronounced co-integration, not coin-tegration) exists between stock-to-flow and the price of bitcoin. Cointegration is supposed to hint at a causal relation between the two variables. When it ultimately came out that the cointegration property does not exist between stock-to-flow and price, this was interpreted as meaning that a change and stock-to-flow cannot possibly cause a change in price. A death blow to the S2F model! But is that really the case?

I had never heard of cointegration prior to 2019, when studying the stock-to-flow model. It is a concept that is widely used in econometrics, but not in any other fields (as far as I am aware). For example, in March 2020 Judea Pearl, the de-facto inventor of causal statistics and author of the “Book of Why” had not heard of cointegration either! He gave two clarifying statements that cointegration might give an indication that there is causal relation, but that it by no means implies a causal relation. In 2022, Pearl again lamented that no one was able to satisfactorily explain the concept of cointegration to him.

The fact that the inventor of causal statistics did not know about the concept of cointegration is telling: The importance of cointegration seems overblown. The lack of cointegration might perhaps hint at trouble for the S2F model, but it should not be considered a death blow.

The arguments against the S2F model we have seen so far either have no merit (supposed tautology, ad hominems), or perhaps weaken the credibility of the model but do not rule it out (lack of cointegration, auto-correlations).

What we should do is rely on empiricism: Is the S2F model able to predict future prices correctly? This is the litmus test for any price model.

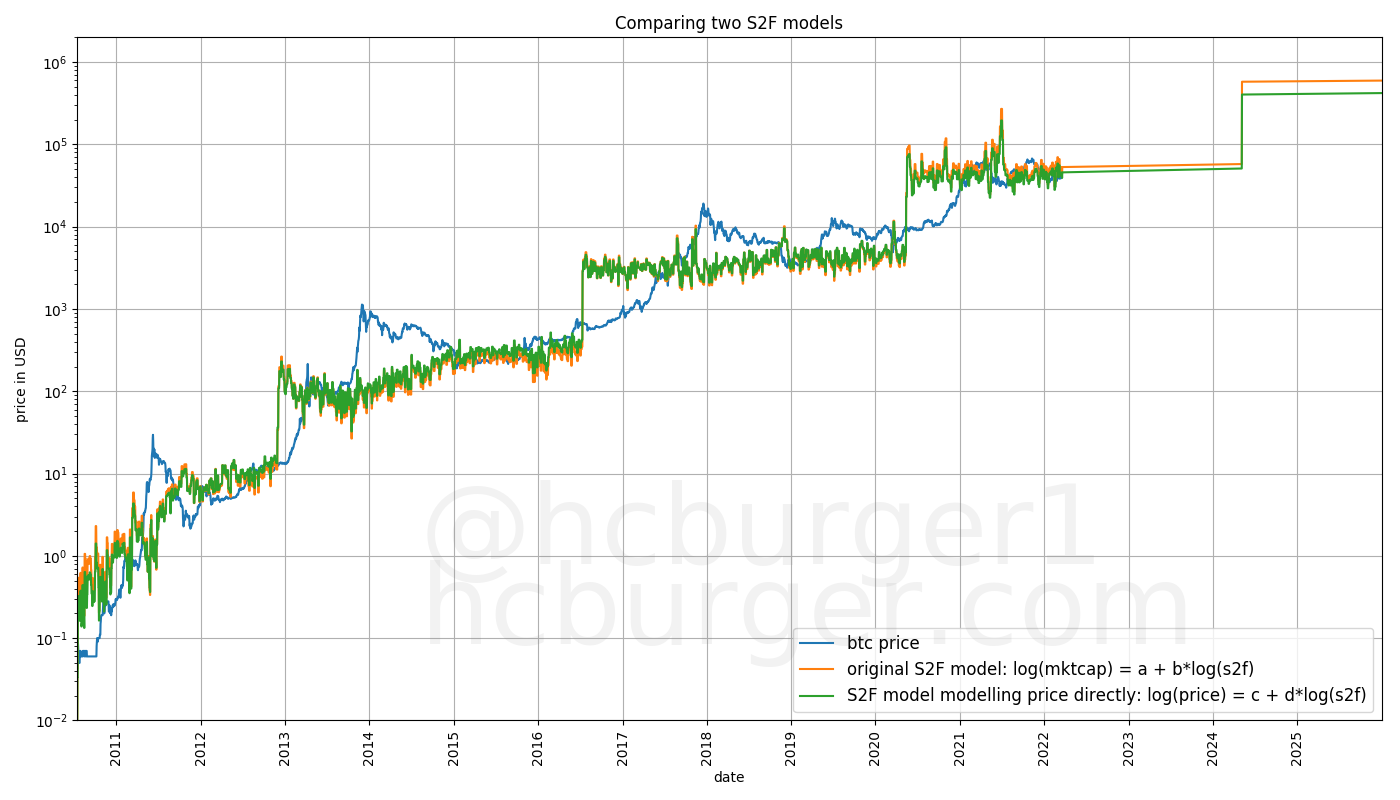

I have created a bitcoin price model called the power-law corridor of growth which relies on the observation (which I owe to Giovanni Santostasi’s reddit post) that bitcoin’s price follows a straight line when plotted using an x-axis that is scaled logarithmically.

This simply means that bitcoin’s price growth is slowing down. Whereas it used to take only about a year for the price to appreciate ten-fold, it now takes several years. Returns are diminishing, and I expect this trend to continue into the future.

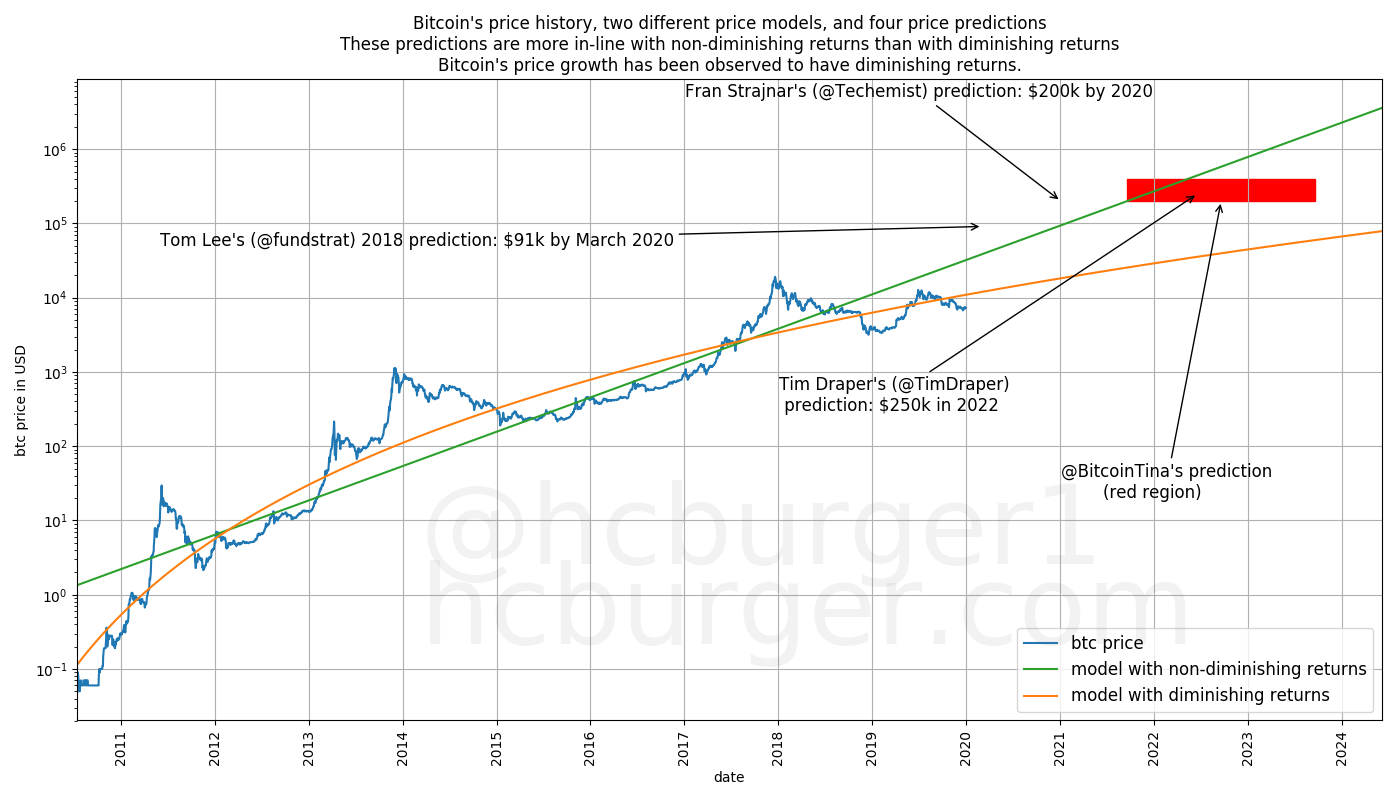

Yet, many people seem to assume that bitcoin’s price will behave similarly in the future as it did in the past. In other words, they expect price increases to happen at the same pace as in the past. I have published the below plot in an article at the end of 2019. Various people have made predictions apparently based on the assumption of non-diminishing growth (roughly represented by the green line). I predicted that these forecasts would prove to be too bullish, and that the price would more closely follow the orange line, which is governed by diminishing returns.

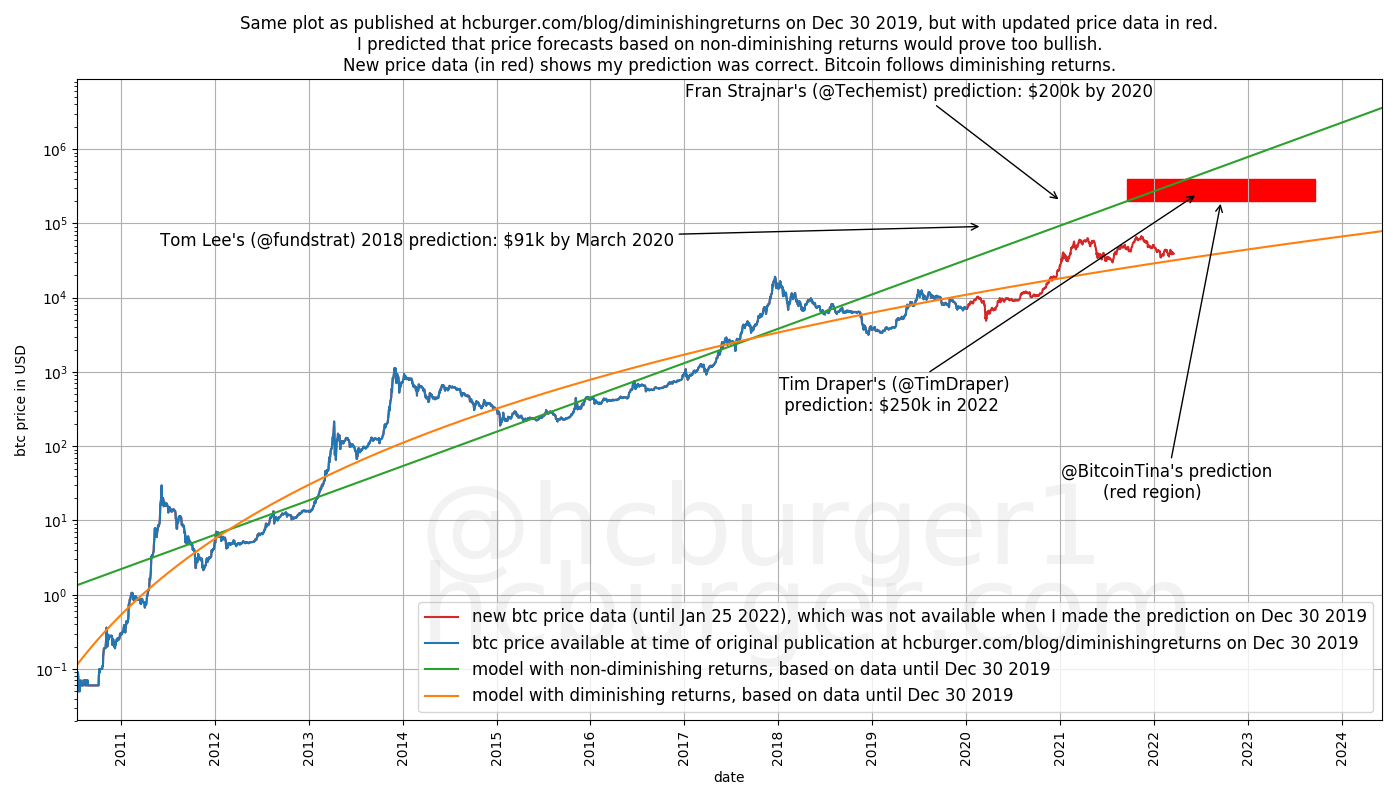

How has my prediction fared? The next plot is the exact same as the previous one, but with the addition of price data (in red) which is now available and that was not available at the time I made the prediction.

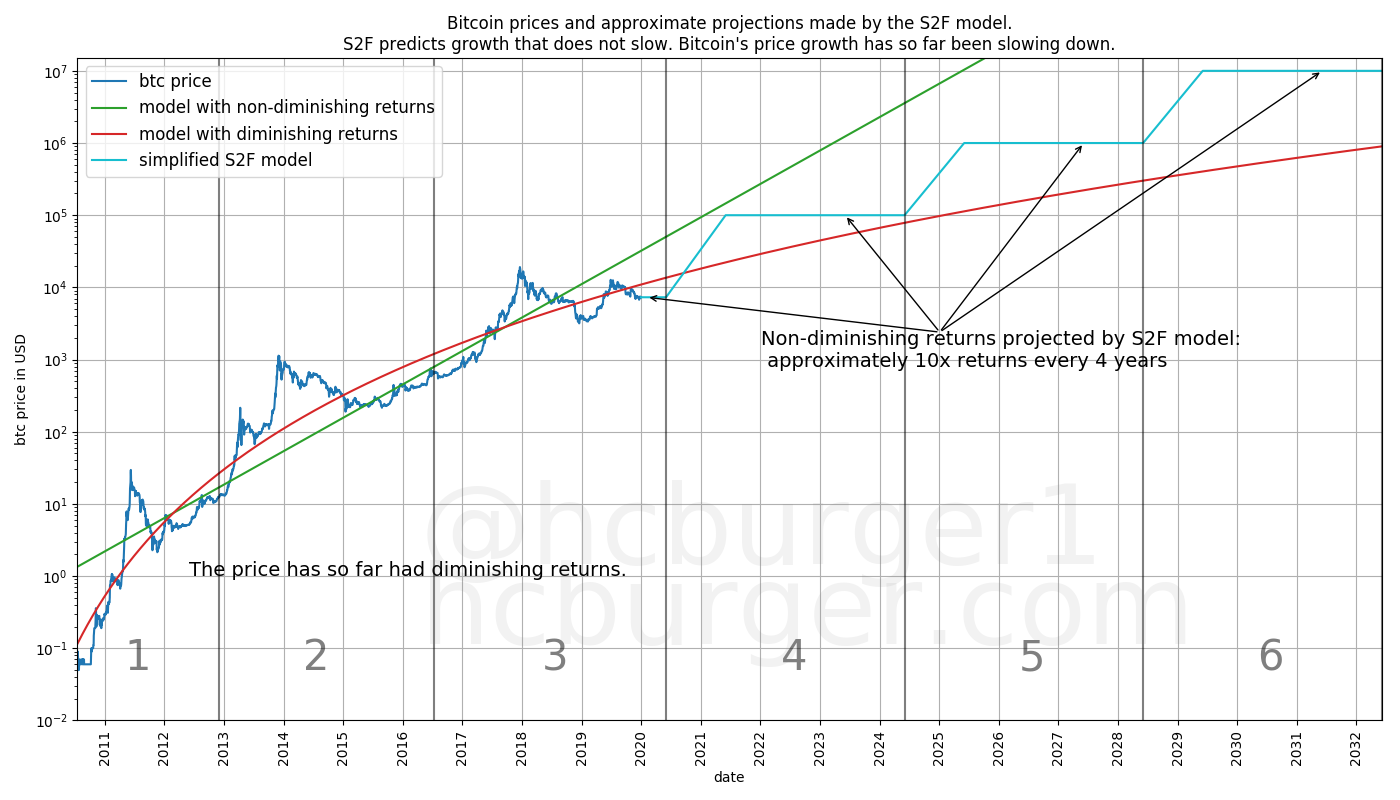

My 2019 prediction proves to have been prescient. What does this mean for the S2F model? In the same article I explained that S2F forecasts non-diminishing growth, and that I therefore also expect it to be too bullish, similarly to the forecasts made by the individuals above. Below is the plot that I published.

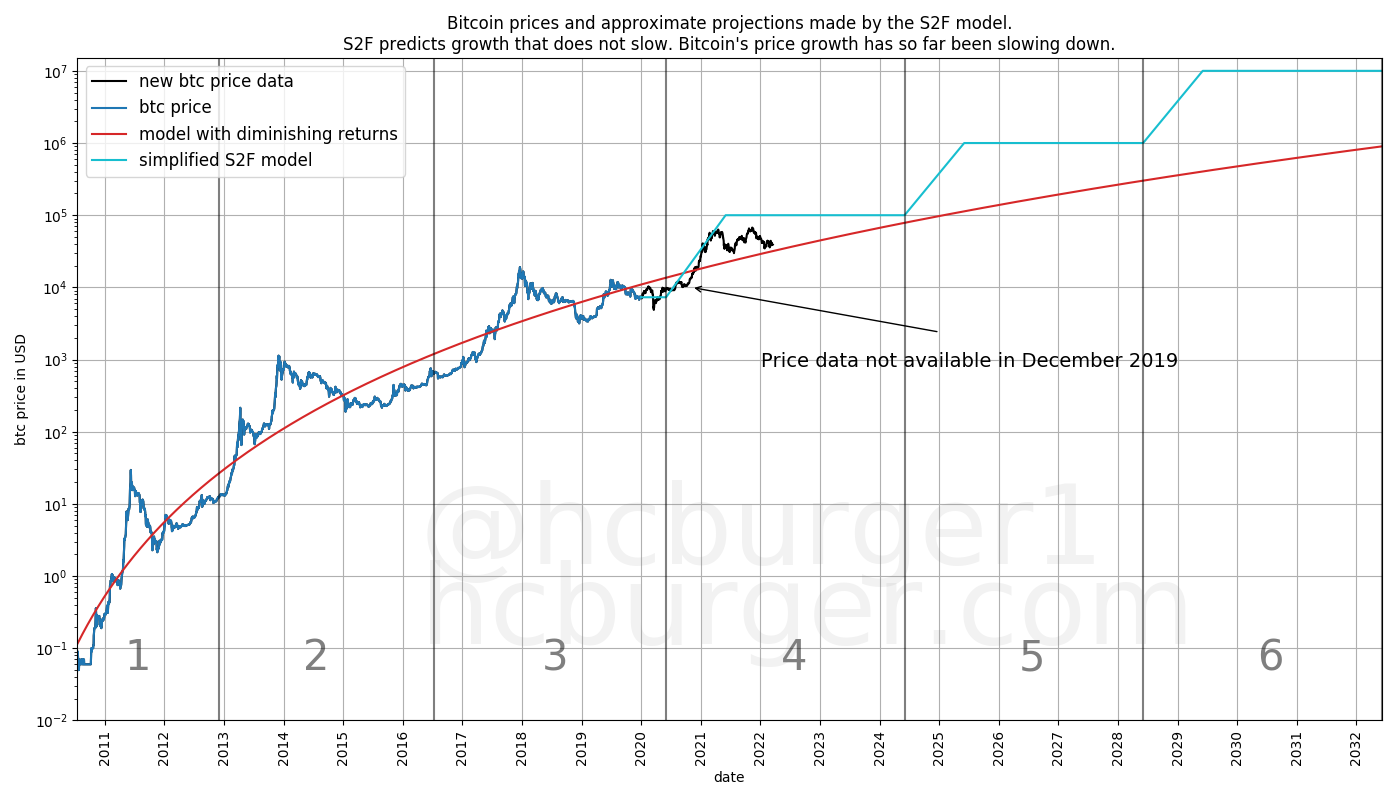

The same plot can now be filled in with more recent price data.

Again, it would appear that bitcoin’s price more closely follows a trajectory with diminishing returns. I therefore expect the price to move further and further away from the S2F forecasts in the long term.

The more mathematically inclined reader might be interested in an article I co-authored with InTheLoop which explains in more detail how the shape of the S2F price curve does not match the actual price data well.

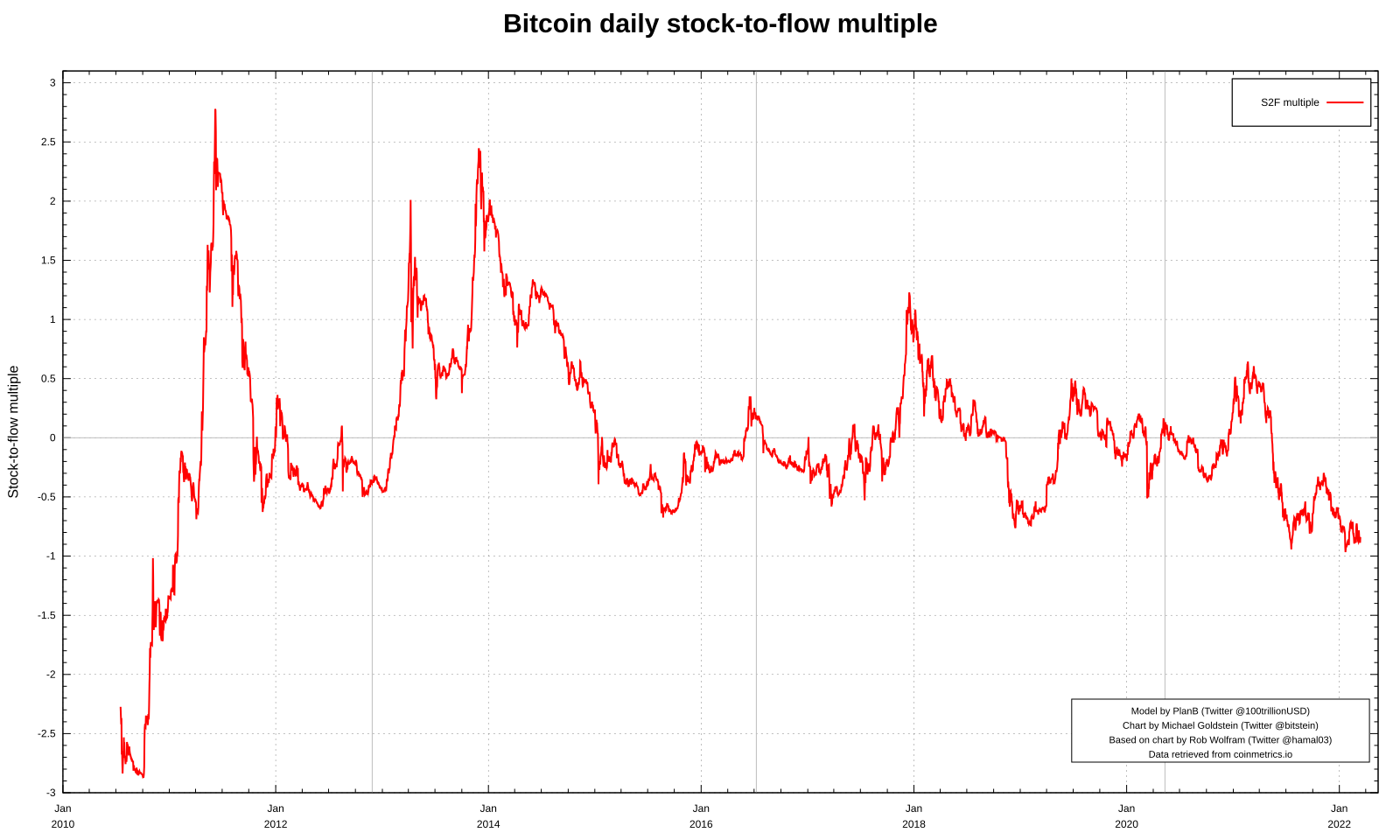

The popular Twitter handle s2fmultiple tracks how the price is performing compared to the S2F forecasts. The metric is referred to as the S2F multiple. A multiple greater than 0 means that the price is higher than the S2F multiple, and vice versa.

The history of the S2F multiple so far looks like the below plot. There have often been high values before 2015, but not so much after that. This is a hint that the price is not quite catching up to the S2F model forecasts (and also that the shape of the S2F price curve does not match actual price data well).

source: https://twitter.com/s2fmultiple

source: https://twitter.com/s2fmultiple

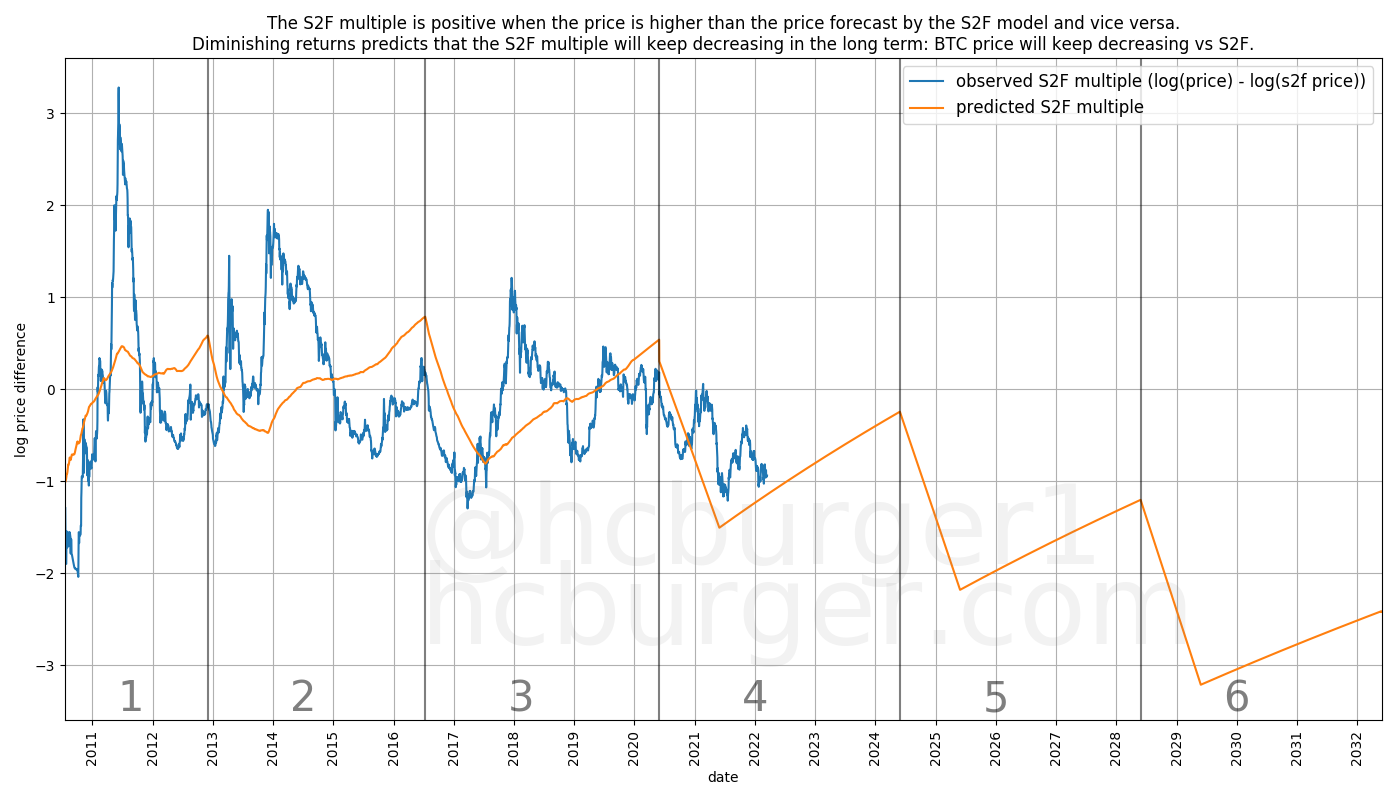

By comparing my own power-law corridor of growth forecasts to the S2F model, I am able to compute the trendline of how I expect the S2F multiple to evolve in the future.

The S2F model has been heavily criticized, often unfairly. I am highly confident that the S2F model will fail to predict bitcoin’s price adequately, but my main argument is simply that the shape of the S2F price forecasts is incorrect and too bullish. The S2F model forecasts non-diminishing growth, which is not justified by empirical observations, which instead strongly hint at diminishing growth.

This does not mean that we should feel disappointed. Bright days lie ahead for the price of bitcoin. In my original article I have forecast a price of $100 000 per bitcoin no earlier than 2021 and no later than 2028, and $1 000 000 per bitcoin no earlier than 2028 and no later than 2037. I still expect these forecasts to come true.