Bitcoin has created an asset class of its own in the financial world. It is so different from asset classes that have existed prior to it, that it is difficult to both:

Concerning the valuation model, some figures who are well-versed in traditional finance have declared that Bitcoin should and will have a value of 0 (Roubini, Taleb) in spite of the fact that predictions of impending doom having been done repeatedly since at least 2010 yet have (so far) failed to materialize.

Nassim Nicholas Taleb has recently published an article “Bitcoin, Currencies, and Fragility” and supplementary material “Bitcoin, Currencies, and Fragility: Supplementary Discussions” (hereafter referred to as “the Bitcoin black paper”), which among other things declares bitcoin to have an expected value of no more than 0.

I will focus mostly on the statement that Bitcoin’s expected value is no higher than 0. I will show that his line of reasoning is inconsistent. He makes a few claims which are false, and once corrected for, make his reasoning even weaker. Overall, he fails to make a convincing case.

Taleb makes a list of other statements about Bitcoin: it not being a currency, not an inflation hedge, and not a safe haven. These statements are not supported by compelling arguments. Finally, he makes a recommendation regarding how a currency free from government should be designed. The recommended approach is very light on details, but achieves the opposite of what it is meant to achieve: It is (much) more fragile than Bitcoin and therefore likely doomed to failure.

Perhaps the most important argument made in the Bitcoin black paper is that Bitcoin supposedly possesses an “absorbing barrier”, a flaw that precious metals supposedly lack, and that this property causes Bitcoin to be worth 0.

An absorbing barrier is a point in time when an asset becomes worth 0, and never recovers (hence it is “absorbed” by the barrier). Think of a gambler at a casino: At some point, he will be ruined. This is his absorbing barrier. We do not know when this event will happen, but we do know that odds are against him and that if he plays long enough, he will hit this barrier. According to Taleb, Bitcoin also possesses an absorbing barrier.

The absorbing barrier is not meant to be a specific event: It refers to any event from which Bitcoin cannot recover. Some ideas I could come up with are: a well-coordinated worldwide ban on Bitcoin, a prolonged internet failure, tech failure (say it turns out that pre-images to a double round of SHA-256 can be found effortlessly and hence a mean block time of 10 minutes cannot be enforced), total loss of interest (for example because something much better replaces it), a major exchange hack or problem with something like Tether leading to a large price drop that snowballs to further price drops, until the price reaches 0 and stays there. I do not mean to say that any of these scenarios are likely - it is a thought exercise, attempting to answer the question: “Assuming that Bitcoin failed, which scenario could have brought it to failure”?

Let us first follow Taleb’s train of thought regarding the absorbing barrier, and comment later.

Taleb argues that the difference between Bitcoin and precious metals lies in the fact that Bitcoin requires active maintenance, and that this causes Bitcoin to have an absorbing barrier, but not precious metals like gold. In Taleb’s own words:

“Comment 1: Why BTC is worth exactly 0

Gold and other precious metals are largely maintenance free, do not degrade over an historical horizon, and do not require maintenance to refresh their physical properties over time. Cryptocurrencies require a sustained amount of interest in them.”

He continues his argument here:

“Path dependence is a problem. We cannot expect a book entry on a ledger that requires active maintenance by interested and incentivized people to keep its physical presence, a condition for monetary value, for any period of time — and of course we are not sure of the interests, mindsets, and preferences of future generations. Once bitcoin drops below a certain threshold, it may hit an absorbing barrier and stays at 0 — gold on the other hand is not path dependent in its physical properties.”

Because of the absorbing barrier, Bitcoin is supposedly worth 0:

“Principle 1: Cumulative ruin

If any non-dividend yielding asset has the tiniest constant probability of hitting an absorbing barrier (causing its value to become 0), then its present value must be 0.”

Bitcoin is indeed a non-dividend yielding asset. He expands this argument in the supplementary material:

“Now, bitcoin is all in the second term, with a hitch: there is an absorbing barrier — should there be an interruption of the ledger updating process, some loss of interest in it, a technological replacement, its value is gone forever. As we insist, bitcoin requires distributed attention.”

Here, it is probably important to expose the discounted cash flow (DCF) model used by Taleb. A discounted cash flow model is a way of obtaining a present value for an asset that has a certain expected future value, and possibly also yields dividends. The “trick” lies in the fact that future valuations are “discounted”, i.e. are valued less than present valuations. The “discount rate” (a concept related to the rate of interest)  determines the strength of this effect: the higher this value, the more important present valuations are compared to the future.

determines the strength of this effect: the higher this value, the more important present valuations are compared to the future.

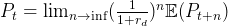

Using a straightforward derivation, Taleb arrives at the following expression for the price  at time

at time  of a non-dividend yielding asset with no absorbing barrier:

of a non-dividend yielding asset with no absorbing barrier:

, where  is a period of arbitrary length e.g. a year.

is a period of arbitrary length e.g. a year.

In other words, the price of the asset at present is determined by its expected value infinitely in the future.

Taleb then explains that the only way for  to have a non-zero value, the price must grow exponentially at a rate of around

to have a non-zero value, the price must grow exponentially at a rate of around  forever. If it did not, then the term containing the discount rate would cause the expected price to shrink to 0.

forever. If it did not, then the term containing the discount rate would cause the expected price to shrink to 0.

Taleb explains that such growth rates are impossible:

“Cases of

growing faster than

are never considered as the price becomes explosive (intuitively, given that we are dealing with infinities, it would exceed the value of the economy).”

Complicating matters further for Bitcoin is the existence of the absorbing barrier:

“Now, bitcoin is all in the second term, with a hitch: there is an absorbing barrier — should there be an interruption of the ledger updating process, some loss of interest in it, a technological replacement, its value is gone forever. As we insist, bitcoin requires distributed attention.”

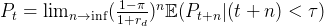

He introduces the variable  which is the probability of Bitcoin being “absorbed” (by the absorbing barrier) at any one time period. The variable

which is the probability of Bitcoin being “absorbed” (by the absorbing barrier) at any one time period. The variable  denotes the time period at which Bitcoin is absorbed. Using a similar derivation as before, he now arrives at a new expression for the price

denotes the time period at which Bitcoin is absorbed. Using a similar derivation as before, he now arrives at a new expression for the price  at time

at time  of a non-dividend yielding asset with an absorbing barrier:

of a non-dividend yielding asset with an absorbing barrier:

.

.

The expression looks very similar to the previous one, and the conclusion is similar as well, except that the growth rate now needs to be  instead of

instead of  for the asset without absorbing barrier:

for the asset without absorbing barrier:

“For the price to be positive now,

must grow forever, exactly at a gigantic exponential scale,

, without remission, and with total certainty.”

Given that a growth rate of  was already considered impossible by Taleb (independent of the exact value of

was already considered impossible by Taleb (independent of the exact value of  ), a growth rate of

), a growth rate of  (again, independent of the exact value of

(again, independent of the exact value of  ) is considered even more impossible. Hence, Bitcoin must be worth 0. Taleb expresses it thus:

) is considered even more impossible. Hence, Bitcoin must be worth 0. Taleb expresses it thus:

“Furthermore bitcoin is supposed to be hacker-proof and is based on total infallibility in the future, not just at present. It is crucial that bitcoin is based on perfect immortality; unlike conventional assets, the slightest mortality rate puts its value at 0. [Footnote:] To counter the effect of the absorbing barrier, the asset must grow at an exponential rate forever, without remission, and with total certainty. Belief in such an immortality for BTC — and its total infallibility — is in line with the common observation that its enthusiastic investors have the attributes of a religious cult.”

The argument can be summarized thus: Bitcoin possesses an absorbing barrier, whereas gold does not. Because Bitcoin yields no dividends, the discounted cash flow model requires Bitcoin’s price to either: 1. grow exponentially, or 2. be headed towards 0. The absorbing barrier makes this situation worse, requiring an even greater growth rate.

Let us first investigate the existence of the absorbing barrier, and then about its effect.

Let us list the arguments Taleb employs in favor of the existence of an absorbing barrier for Bitcoin. They are contained in the following four quotes:

“Path dependence is a problem. We cannot expect a book entry on a ledger that requires active maintenance by interested and incentivized people to keep its physical presence, a condition for monetary value, for any period of time — and of course we are not sure of the interests, mindsets, and preferences of future generations. Once bitcoin drops below a certain threshold, it may hit an absorbing barrier and stays at 0 — gold on the other hand is not path dependent in its physical properties.”

“Now, bitcoin is all in the second term, with a hitch: there is an absorbing barrier — should there be an interruption of the ledger updating process, some loss of interest in it, a technological replacement, its value is gone forever. As we insist, bitcoin requires distributed attention.”

“The implication is that, owing to the absence of any explicit yield benefitting [sic] the holder of bitcoin, if we expect that at any point in the future the value will be zero when miners are extinct, the technology becomes obsolete, or future generations get into other such”assets” and bitcoin loses its appeal for them, then the value must be zero now.”

“Critically the probability of hitting the barrier does not need to come from price dynamics, but from any failure rate — the only assumption here is a failure rate >0.”

There are four arguments:

The second argument can be applied to anything else, including precious metals such as gold. People might lose interest in precious metals in the future. This might seem unlikely, but the point is that we don’t know, and we are not attempting to quantify this probability, we are merely asking if this event has a non-zero probability at any point in the (arbitrarily far) future. Since the whole “absorbing barrier argument” relies on making a difference between Bitcoin and precious metals, this argument can be dismissed.

Concerning the third argument, it is not clear that a technological replacement is qualitatively different from the “loss of interest” argument: A hypothetical technological replacement (which would have to overcome the enormous network effects of Bitcoin) could be said to cause loss of interest in Bitcoin. As with the second point, the same argument applies to gold: Something else could replace gold (another precious metal such as platinum, a substance that is yet to be discovered or invented, a technology such as Bitcoin, or something completely different).

Concerning the fourth argument, Taleb says that the absorbing barrier argument holds no matter what the source of the failure might be. We can concede this point, but have to note that the same also holds for gold: If gold has any possibility of failure, it has to be considered in the same way as Bitcoin.

It would therefore seem that Taleb makes a distinction between Bitcoin and gold mainly on the basis of the supposed permanent need for mining (which is energy consuming), with a temporary stop in mining leading to a permanent loss of the ledger. This argument seems to betray a lack of understanding of Bitcoin the technology on the side of Taleb. Mining is NOT necessary in order to keep the ledger alive. All that is needed is a single copy of the ledger, anywhere in the world. This ledger can then be verified by software (a Bitcoin full node) to follow all the rules of the Bitcoin protocol. Anyone having run a Bitcoin full node such as Bitcoin Core will know this (lengthy) process “Synchronizing with network”. Taleb is therefore wrong that mining is necessary to maintain the ledger. Mining is only necessary to extend the ledger with new blocks. To maintain the network, only storage and transmission of the ledger is necessary, not mining. Storage and transmission of a single copy of the blockchain is extremely cheap (and will arguably become cheaper with improving technology) and cannot be considered to be something requiring “active maintenance”.

It is true that mining is required to extend Bitcoin’s ledger with additional blocks. However, no great harm will happen if mining stops for a short period of time: the network will likely get “congested” with un-confirmed transactions, and users will get a sub-optimal user experience of having to wait for more than the usual 10 minutes (on average) before transactions are confirmed on the ledger. A total interruption of mining would therefore not necessarily be an absorbing barrier. Furthermore, mining is anti-fragile: if some miners stop mining, the financial incentive for the remaining miners becomes greater. Recently, the Bitcoin hash rate has dropped by about 50%, due to an apparent ban on industrial-scale mining in China. Block creation times have increased for a while , and the remaining miners rejoiced because of the additional financial incentive.

Another quote that betrays Taleb’s lack of technical understanding:

“3) the concept of proof of work (used to deter spam by forcing agents to use computer time in order to qualify for a transaction)”

This statement is not true: the concept of proof of work is not used as a spam deterrent, but as a mechanism to trustlessly (or rather: trust-minimally) avoid double-spends. Solving the double-spend problem (or Byzantine general’s problem) is THE problem which Bitcoin solves. Proof-of-work is therefore critical to the functioning of Bitcoin, but it is not a spam deterrent. Taleb might be thinking of Adam Back’s Hashcash, which can be considered a precursor to Bitcoin, with the single use-case of deterring e-mail spam.

Yet another statement about mining that is incorrect:

“The proof of work method has an adjustable degree of difficulty based on the speed of blocks, which aims, in theory, to keep the incentive sufficiently high for miners to keep operating the system. Such adjustments lead to an exponential increase in computer power requirements”

He claims that the difficulty adjustment mechanism of mining incentives lead to an exponential increase in computing power. Perhaps he believes this to be the case because mining has so far increased dramatically, which is a natural result of the combination of 1. the price having increased dramatically and 2. the mining reward per block to have decreased only by a factor of 8 , which is inconsequential compared to the price increase. Or perhaps he believes this to be the case because according to him, the price must increase exponentially (or otherwise be headed to 0). However, long term, the mining power will be determined solely by the amount of transaction fees being paid by the users. Again: The mining incentives are correct, making mining anti-fragile. Mining will happen to the extent that people are willing to pay for it. Since we cannot know how much users will spend on transaction fees in the future, we cannot make any definite statements regarding future computing power requirements. We could for example imagine a world in which bitcoin is enormously valuable and continues to increase in value exponentially, yet more and more coins become illiquid, leading to relatively low demand for on-chain space. The strength of the two effects might offset each other and we could even imagine a world in which mining power decreases with time.

A point that Taleb fails to mention regarding the absorbing barrier is that when Bitcoin was conceived, it was arguably below the supposed absorbing barrier. Bitcoin started out with a value of 0, and likely a single individual (Satoshi) was mining. In mid 2009, the total hash rate dropped to virtually 0. Yet, in 2010, the network showed growth, both in terms of users, hash rate, and soon thereafter also in terms of price. This example seems to empirically contradict the existence of an inherent absorbing barrier for Bitcoin. If not, Taleb should have at least explained why this obvious example does not contradict his reasoning.

In summary, Taleb does not make a convincing case that Bitcoin should be treated any differently from precious metals regarding the existence of an absorbing barrier. The mining argument is wrong, and the remaining arguments are applicable to both Bitcoin and precious metals. Finally, he unfortunately does not explain how the absorbing barrier argument is compatible with Bitcoin coming to life in the first place.

Taleb divides the supplementary material dealing with the discounted cash flow into two parts:

and puts Bitcoin into the second category. Gold and other precious metals, per Taleb’s prior reasoning, belong into the first category. What difference does it make into which category an asset lands?

Per Taleb, assets with no absorbing barrier must grow exponentially, at a rate of around  :

:

“We notice that the second term vanishes under the smallest positive discount rate. In the standard rational bubble model P […] needs to grow around

forever. Cases of P growing faster than

are never considered as the price becomes explosive (intuitively, given that we are dealing with infinities, it would exceed the value of the economy).”

Whereas assets with absorbing barrier must grow exponentially, at a rate of around  :

:

“For the price to be positive now,

must grow forever, exactly at a gigantic exponential scale,

, without remission, and with total certainty.”

So: both types of assets need to grow exponentially, but assets with no absorbing barrier need to grow at  , whereas assets with absorbing barrier need to grow at

, whereas assets with absorbing barrier need to grow at  , where

, where  is the discount rate and

is the discount rate and  is the probability of hitting the absorbing barrier for one time period. Assets with absorbing barrier need to grow at a rate of

is the probability of hitting the absorbing barrier for one time period. Assets with absorbing barrier need to grow at a rate of  faster than assets without absorbing barrier.

faster than assets without absorbing barrier.

To argue that  is problematic one would have to argue that it is a non-negligible term, or that it is a term that increases over time. Yet, Bitcoin is in its thirteenth year of existence and has still not hit the absorbing barrier. If we were to attempt to estimate

is problematic one would have to argue that it is a non-negligible term, or that it is a term that increases over time. Yet, Bitcoin is in its thirteenth year of existence and has still not hit the absorbing barrier. If we were to attempt to estimate  empirically, each year Bitcoin continues to exist, the estimate of the value of

empirically, each year Bitcoin continues to exist, the estimate of the value of  needs to go down! In the limit,

needs to go down! In the limit,  is then headed towards 0, and Bitcoin becomes an asset with no absorbing barrier.

is then headed towards 0, and Bitcoin becomes an asset with no absorbing barrier.

The remaining question is whether assets can grow exponentially at a rate of around  :

:

“Cases of P growing faster than

are never considered as the price becomes explosive (intuitively, given that we are dealing with infinities, it would exceed the value of the economy).”

The answer depends on which discount rate  is being used. For example, major stock indices like the S&P500 have grown at around 10% per annum in the long term. We therefore already know that assets can indeed grow faster than

is being used. For example, major stock indices like the S&P500 have grown at around 10% per annum in the long term. We therefore already know that assets can indeed grow faster than  if

if  is smaller than 10%.

is smaller than 10%.

Since discounted cash flow models are used to arrive at an estimate of the value of an investment, and none of the parameters are set in stone,  can be freely chosen by the practitioner of the DCF model. The value chosen will depend on the practitioner’s time cost of money (time preference), and his estimate of the risks of the investment as well as his willingness to take said risks. 10% is a ballpark number that is often chosen, but other methods can be chosen as well, e.g. Warren Buffet has argued that the treasury rate should be the minimum value. Treasury rates are currently much lower than 10% - at the time of writing, about 1.25% for the 10-year treasury. The discount rate should also depend on the type of investment. We could argue that long term, investing in a single stock is much more risky than investing in Bitcoin, should it have attained something like world reserve currency status (therefore warranting lower discount rates for Bitcoin than for stocks).

can be freely chosen by the practitioner of the DCF model. The value chosen will depend on the practitioner’s time cost of money (time preference), and his estimate of the risks of the investment as well as his willingness to take said risks. 10% is a ballpark number that is often chosen, but other methods can be chosen as well, e.g. Warren Buffet has argued that the treasury rate should be the minimum value. Treasury rates are currently much lower than 10% - at the time of writing, about 1.25% for the 10-year treasury. The discount rate should also depend on the type of investment. We could argue that long term, investing in a single stock is much more risky than investing in Bitcoin, should it have attained something like world reserve currency status (therefore warranting lower discount rates for Bitcoin than for stocks).

In any event, we come to the conclusion that assets growing faster than  (or

(or  ) can and do exist, and that Bitcoin might very well be another example of such an asset. The second part of this sentence is also highly problematic:

) can and do exist, and that Bitcoin might very well be another example of such an asset. The second part of this sentence is also highly problematic:

“For the price to be positive now,

must grow forever, exactly at a gigantic exponential scale,

, without remission, and with total certainty.”

This is incorrect both theoretically and empirically. Empirically we have observed Bitcoin to at times decline in value, yet  is still positive (a contradiction). Theoretically the statement is also wrong, because what actually matters is the expectation. The sentence should therefore be rephrased to something like:

is still positive (a contradiction). Theoretically the statement is also wrong, because what actually matters is the expectation. The sentence should therefore be rephrased to something like:

“For the price to be positive now,  must be expected to grow at a rate of at least

must be expected to grow at a rate of at least  .”

.”

which is much less spectacular.

To conclude: Even if we concede the existence of an absorbing barrier, the effect is not necessarily problematic, as Bitcoin’s growth rates long term could be compatible with the model. Over time, the effect of the supposed absorbing barrier,  , should vanish. It is worth repeating that Taleb’s arguments in favor of an existence of an absorbing barrier are inconsistent (see previous section), and therefore the existence of an absorbing barrier should not be conceded.

, should vanish. It is worth repeating that Taleb’s arguments in favor of an existence of an absorbing barrier are inconsistent (see previous section), and therefore the existence of an absorbing barrier should not be conceded.

One thing that was not made clear by Taleb is whether gold and other precious metals should be valued according to the DCF model (without absorbing barrier), or whether gold somehow escapes from this scrutiny. If gold should indeed be scrutinized by the DCF model, per Taleb’s own arguments it must either

, or

, orLooking at 100-year gold chart immediately tells us that gold has NOT grown without remission at an exponential rate. It has even faced periods of several decades of steady price declines. Yet, gold is stubbornly not worth 0. How come?

A discount rate model can be used to estimate the value of an investment (such as a stock), using estimates about prices and cash flows in the future (and are therefore subjective). The discount rate can also be chosen arbitrarily by the practitioner himself. The output of the model will therefore necessarily be highly subjective. Deciding whether yes or no a stock (or Bitcoin) is a good investment will therefore also be subjective, though the model might have helped the reasoning. In the stock market, time frames of typically five or ten years are used. This is indicative of the fact that the future is highly uncertain and looking into the future further than that might make little sense. Yet, Taleb lets the model look into infinity, and argues that

“The implication is that, owing to the absence of any explicit yield benefitting [sic] the holder of bitcoin, if we expect that at any point in the future the value will be zero […] then the value must be zero now.”

Yet this is not true. It leaves out the possibility of Bitcoin being worth 0 in the extremely long term (say billions of years from now), yet have extremely high value from now on and for the next couple of centuries or millennia with extremely high certainty. Should Bitcoin be valued at 0 now because of the possibility of a value of 0 in the far future, in spite of high certainty of high value closer in the future? Certainly not. Taleb makes an error in how backward induction is used: Yes, other things being equal, future prices should be incorporated into present prices, but there might be relevant other information that justifies a high value in the near future and a lower value later.

The use of infinity has another obvious problem: In the far future, the laws of physics (as currently understood) dictate that the universe will die a heat death, we will all be dead, and everything will be worth 0. Hence according to Taleb’s methodology, every non-dividend yielding asset must be worth 0. Granted, this argument is somewhat artificial, since humans are not able to look that far into the future. But then it also does not make sense to run the DCF to infinity.

Independently of the inherent subjectivity of a DCF model, and the use of infinity, does a DCF make sense at all? Taleb states the following.

“Bitcoin would be allowed to escape a valuation methodology had it proven to be a medium of exchange or satisfied the condition for a numeraire from which other goods could be priced.”

This statement requires further scrutiny. In the last section, we saw that according to Taleb’s own logic, gold would have to grow at an exponential rate forever (or else be priced at 0) unless something allows it to be excluded from the DCF framework. Since gold has clearly not grown exponentially forever, yet still has a positive price, we must assume that according to Taleb’s logic, gold is excluded from the scrutiny of the DCF. Since he gives no hint in the paper as to why that is except for the above statement, we must assume that Taleb believes that:

Even if we concede that this logic is sound (which I don’t), we must note that Bitcoin might at some point in the future match the criteria that Taleb requires for Bitcoin to be exempt from the scrutiny of the DCF (i.e. Bitcoin becomes a medium of exchange or numeraire). Should this happen at some point in the future, at that point Bitcoin escapes the valuation methodology of the DCF, according to Taleb’s own logic. Taleb’s formulation of the DCF allows for absolute failure of Bitcoin (per the absorbing barrier), but does not allow for even the slightest possibility of success (becoming a medium of exchange and escaping the valuation methodology), which does not make sense per his own logic. Just as Taleb’s DCF has a value  which is the probability of Bitcoin hitting an absorbing barrier, it should have another value which describes the probability of “success” and escaping the valuation methodology.

which is the probability of Bitcoin hitting an absorbing barrier, it should have another value which describes the probability of “success” and escaping the valuation methodology.

It is too bad that Taleb does not further explain why according to him, a medium of exchange should escape a valuation methodology, as this would perhaps allow us to better estimate the chances of Bitcoin’s success or demise. Since he does not explain, we can only speculate. Presumably what is meant is that a medium of exchange or numeraire is so widely recognized as having value, that it will always have value. In other words, its network effects are strong enough to make it persist. However in that case: When are the network effects considered to be sufficiently strong? What counts as a medium of exchange?

I argue that Bitcoin already enjoys strong network effects, and that these are growing every day Bitcoin continues to exist. I also argue that Bitcoin already is a medium of exchange, as it allows to buy goods and services. The infamous Silk Road and related darknet markets are perhaps the most popular examples, but more legitimate uses also abound. Arguably, Bitcoin is a much better medium of exchange than gold (you can send it over the internet), with perhaps more value transferred using Bitcoin than using gold. It is also becoming more and more used as a medium of exchange, not only thanks to strengthening network effects, but also thanks to technological improvements such as the lightning network (which itself is rapidly growing). We must concede that Bitcoin is currently a bad numeraire, but that does not mean that this must necessarily continue to be the case, and gold is certainly not a good numeraire, either. Taleb therefore does not make a good case that gold should escape the valuation methodology, whereas Bitcoin not. If anything, it should be the reverse.

Choosing to apply the valuation methodology to only certain assets (Bitcoin) but not others (gold) with virtually no explanation further weakens Taleb’s overall argument. The overall approach is certainly not rigorous, and sounds more like an appeal to emotion.

Taleb uses a DCF valuation methodology for Bitcoin but not gold, but it is dubious whether that choice is defensible.

He then argues that Bitcoin has an absorbing barrier, whereas gold does not, but is unable to make a solid case for that statement. He uses an argument related to mining which is factually incorrect. The other arguments he employs are as applicable to gold as they are to Bitcoin, and therefore fail to make his case. Importantly, he leaves out that Bitcoin seems to have already escaped what should have been an absorbing barrier (its early days) and therefore ignores empirical evidence against the existence of an absorbing barrier.

Taleb argues that non-dividend yielding assets that do NOT have an absorbing barrier are also problematic because of a supposed required exponential growth in excess of the discount rate, supposedly requiring the asset to grow explosively and to exceed the size of the economy. He is unclear about whether gold should be considered in this category or not - if yes, then he is shooting himself in the foot. Anyway this argument is rendered moot by the fact that assets with an average growth rate of 10% over the last 100 years do exist, with index funds being one example (and they have not exceeded the size of the economy). Taleb presents no argument why Bitcoin should not be another such asset.

Finally, the effect of the absorbing barrier is unimportant even per his own arguments: a factor  in the required growth rate, which is unknown but tending towards 0 in the long term.

in the required growth rate, which is unknown but tending towards 0 in the long term.

The whole line of reasoning regarding a DCF valuation methodology and arguing about the existence or non-existence of an absorbing barrier makes unnecessarily complicated something that is in fact quite simple and which could be summarized in two sentences:

This leaves out all the incorrect or controversial statements made by Taleb. Stated in this way, I would agree, but must also add that these sentences are almost tautological.

Let’s consider a number of other supposed problems mentioned by Taleb:

“The experience of March 2020, during the market panic upon the onset of the pandemic, when bitcoin dropped farther than the stock market — and subsequently recovered with it upon the massive injection of liquidity is sufficient evidence that it cannot remotely be used as a tail hedge against systemic risk.”

Bitcoin is currently a risk-on asset. I agree.

“Furthermore, bitcoin appears to respond to liquidity, exactly like other bubble items.”

Bitcoin responding to liquidity means that it increases in price when there’s more money in the markets. In other words, it behaves like it’s supposed to. No problem here.

“It is also uncertain what could happen should the internet experience a general, or an even a [sic] regional, outage — particularly if it takes place during a financial collapse.”

Bitcoin transactions need not necessarily be transmitted over the internet. They can be sent over mesh networks, or ham radio. The Bitcoin blockchain itself is broadcast via satellite and can be received via parabolic dish the world over. Further transmission methods might be developed in the future.

This problem is much more serious for anything that needs to be transmitted over proprietary bank networks, rather than an open infrastructure (like Bitcoin). Cash itself would become highly problematic.

Taleb attempts to make the case that Bitcoin could easily be captured by tyrannical regimes.

“By its very nature, bitcoin is open for all to see. The belief in one’s ability to hide one’s assets from the government with a public blockchain easily triangularizable at endpoints, and not just read by the FBI but also by people in their living rooms, requires a certain lack of financial seasoning and statistical understanding — perhaps even a lack of minimal common sense. For instance a Wolfram Research specialist was able to statistically detect and triangularize”anonymous” ransom payments made by Colonial Pipeline on May 8 in 2021 — and it did not take long for the FBI to restore the funds.”

The argument is nonsense on multiple fronts. Bitcoin is much more difficult to capture by a tyrannical regime than a traditional bank account for example. Gold too, is relatively easy to confiscate, due to its physical properties (relatively easy to find, extremely difficult to transfer). Bitcoin by contrast can be made arbitrarily difficult to confiscate - the key is good operational security. The specific example of the Colonial Pipeline which Taleb uses was an example of hackers with amateur-level opsec, not a flaw in Bitcoin.

Taleb attempts to make a case that it is unfair that early adopters are rewarded for their early insight and risk-taking.

“Unfortunately, there appears to be a worse agency problem: a concentration of insiders hoarding what they think will be the world currency, so others would have to go to them later on for supply. They would be cumulatively earning trillions, with many billionaire”Hodlers” […]. This situation represents a wealth transfer to the cartel of early bitcoin accumulators.”

I completely fail to recognize the argument. Is it also unfair then, that early investors of a successful company hoard what they think will be a highly valued stock, so others would have to go to them later on for supply? Should risk-taking and early foresight not be rewarded? Taleb does not seem to have an argument at all - he merely makes an appeal to emotion, specifically jealousy. This part of the black paper is especially confusing considering that Bitcoin’s emission schedule and distribution mechanism should be lauded for its fairness - in great contrast to how fiat money enters the markets and creates a Cantillon effect in favor of the already wealthy and powerful.

Taleb attempts to make an argument also made by his friend Roubini, that Bitcoin is expensive, slow, and cannot scale:

“Transactions in bitcoin are considerably more expensive than wire services or other modes of transfers, or ones in other cryptocurrencies. They are order of magnitudes slower than standard commercial systems used by credit card companies — anecdotally, while you can instantly buy a cup of coffee with your cell phone, you would need to wait ten minutes if you used bitcoin. They cannot compete with African mobile money. Nor can the system outlined above — as per its very structure — accommodate a large volume of transactions — which is something central for such an ambitious payment system.”

Bitcoin has a built-in transfer network which indeed is not very scalable (it’s a broadcast network) and it has at times been expensive to send transactions. It is indeed true that the mean confirmation time of a transaction on this built-in network is ten minutes. But there is no reason why Bitcoin the currency should be limited to a single transfer network! For example, Bitcoin could trivially scale globally using custodial payment servers, just like the US Dollar and all other major currencies already do.

The lightning network is another example of how Bitcoin could scale globally. Transactions on the lightning network are instantaneous, and the network can scale enormously because not everyone is aware of all of everyone else’s transactions. Transactions are also extremely cheap, much cheaper than any traditional means of payment. In addition, the lightning network is trust-minimized, just like Bitcoin’s base layer.

Other potential solutions exist, such as two-way pegged sidechains (for example via BIP 300+301), using either big-block sidechains or a sidechain that does not perpetually grow in size, such as MimbleWimble. Paul Sztorc calls this concept the Thunder Network.

It is therefore not credible that Bitcoin could not possibly scale globally. It is a shame that Taleb tries to use this argument, especially because he must be aware of the lightning network, yet chooses not to mention it.

Taleb shows a plot of Bitcoin’s three month annualized volatility over time and comments that volatility does not seem to decrease:

“Now bitcoin, as seen in Fig.1 has maintained extremely high volatility throughout its life (between 60% and 100% annualized) and, what is worse, at higher prices, which makes it’s [sic] capitalization considerably more volatile, rising in price as shown in Fig. 2 […]”

Indeed, high volatility is bad for a numeraire. A priori, we would expect an asset to have less and less volatility the higher its marketcap, due to deeper order books: More and more money should be needed to move the price. We would therefore expect Bitcoin’s volatility to gradually decrease with time (and increasing price).

There is an additional reason to expect diminishing volatility in the long term: The more Bitcoin is used as a medium of exchange, the more arbitrage opportunities come about, leading to a dampening of volatility. Taleb himself explains that liquidity effects can compound, leading a currency that is volatile but heavily used to become less volatile:

“There could be an interactive relationship between trade and volatility: one can argue that the stability of a currency-pair (adjusted for the yield curve) encourages trade and trade in turn brings stability to the pair.”

I have shown empirically that measures of volatility have indeed decreased with time. The reason why I arrive at the opposite conclusion than Taleb is because I also considered longer periods of time than three months (and also other measures of volatility). I do concede that Bitcoin’s volatility is currently too high to be considered a good numeraire, but I don’t see any fundamental reason why things should not continue to evolve towards lower volatility.

Taleb devotes a section of his paper to describing how a currency without a government could be created, according to him. The central tenet of the argument is described in this comment:

“Comment 3: Payment system

There is a conflation between “accepting bitcoin for payments” and pricing goods in bitcoin. To “price” in bitcoin, bitcoin the price must be fixed, with a conversion into fiat floating, rather than the reverse.”

In other words, Bitcoin should be flipped on its head. Instead of having a rigid money supply, prices of goods should instead be denominated in Bitcoin, and the conversion rate to Bitcoin should be floating (presumably by changing the money supply of Bitcoin so as to get stable prices of goods). This is of course antithetical to what Bitcoin aims to achieve.

He elaborates that a desirable currency should have stable prices on a “weighted basket of goods”:

“This does not mean that a cryptocurrency cannot displace fiat – it is indeed desirable to have at least one real currency without a government. But the new currency just needs to be more appealing as a store of value by tracking a weighted basket of goods and services with minimum error.”

He argues that having such a currency with minimal variance competing against other currencies would be convenient as an inflation hedge:

“Thus we can look at an inflation hedge as the analog of a minimum variance numeraire.”

And:

“This competition provides for a vastly more convenient monetary store of value. For practitioners of quant finance, the most effective inflation hedge can be a combination of bets which includes short positions in government bonds.”

His proposal could be described as being similar to a “stablecoin” such as Tether or DAI, except that his currency (let’s call it Talebcoin) would not stay stable relative to the US dollar, as Tether or DAI do, but instead to a “basket of goods and services”. He does not describe in detail how such a system might work. He makes no mention of which mechanisms would be used to achieve a price stability with respect to a basket of goods, collateral, legal aspects, or governance. Is such a Talebcoin feasible? Moreover, is it desirable?

We are forced to speculate as to the implementation details of Talebcoin. The closest existing concept are stablecoins, of which there are broadly speaking three varieties:

All examples of stablecoins I am aware of are designed to track a major fiat currency, most commonly the USD. Each variety of stablecoin comes with its own drawbacks. Tracking a basket of goods instead of a major currency comes with additional difficulties.

Fiat-backed stablecoins such as Tether (run by the Tether Limited company) work by keeping as collateral an amount of fiat currency (USD) that is equivalent to the amount of stablecoin (Tether) in circulation. If these two amounts equal each other, the system is stable and can function (TUSD is then pegged to the USD). If however Tether is not fully backed, then the currency can collapse (and likely will, if it is discovered that reserves are fractional). It has to be added that:

Therefore, Tether has been widely accused of being a scam and a disaster waiting to happen.

Cryptocurrency-backed stablecoins such as DAI work by instead keeping cryptocurrency (such as ETH) as collateral. A further difference is that these stablecoins usually operate based on smartcontracts, on a platform such as Ethereum, and are therefore auditable. A major drawback is that cryptocurrencies are very volatile. DAI addresses this problem by requiring that the cryptocurrency deposited as collateral cover the amount of DAI by at least 150%. If the cryptocurrency used as collateral falls in value, one is liquidated, possibly losing all DAI. In addition to this enormous risk, DAI is relatively complex, with several types of actors involved, each with a different role.

Seigniorage-based stablecoins use no collateral and instead attempt to control prices using monetary policy. If the price of the stablecoin is higher than desired, new coins are simply emitted and put on the market. If the price is too low things are more complicated, and a scheme has to be invented to reduce the supply of the coin. Choosing such a scheme is difficult - who would be willing to have his or her supply of money cut? Other problems with such schemes are the overall complexity, and the fact that in practice, prices are in fact not stable.

Stablecoins that track a major currency are difficult enough. Tracking a basket of goods and services is even more difficult. For example, how would Talebcoin work if it was fiat-backed? What happens if it takes “too many” Talebcoins to buy the goods in the basket? The supply of Talebcoins would certainly have to be reduced. But how? And again: Who would accept that his or her supply of coins were cut? If it takes “too few” Talebcoins to buy the goods in the basket, we have the reverse question. Surely more Talebcoins have to be emitted? Who gets the new coins? Are they distributed equally (so as to reduce the Cantillon effect)? That would not have the desired impact on the market: many newly minted Talebcoins would likely stay dormant and have little effect on the price. Should the new Talebcoins be immediately sold on exchanges? Who emits these new Talebcoins and reaps the benefits of emitting new Talebcoins? Would this considered to be fair by the users of Talebcoin, or would they prefer another scheme, perhaps one that has less of an aim of price stability, and more of an aim of a solid monetary emission and distribution (such as Bitcoin)?

A lot of questions already arise. Yet the question of the basket of goods and services has not even been considered yet: Who should decide on the goods and services and their weightings? How should they change over time, and how quickly should they be allowed to change? Since there is no “correct” choice of goods and services, the choice is ultimately subjective, and will benefit some participants more than others. Whom should the scheme benefit the most? To give just an example: Should Talebcoin track consumer or producer prices? Choosing the former means that the latter benefits less, and vice versa. What’s the correct weight for the price of beef in the basket? Too low and it benefits vegans and vegetarians over carnivores. Which one is “correct”? These difficulties are widely recognized. At least Taleb agrees that this is a difficult question:

“Even categories have their weights naturally revised over time: the share of food and clothing declined by almost threefold as a proportion of Western consumers expenditure since the great recession.”

In all likelihood, Talebcoin would therefore be complex to implement. It would be at least as complex as existing stablecoins, all of which are already more complex than Bitcoin. In addition, Talebcoin is likely to require a trusted third party that acts much like a central bank. If Talebcoin is fiat-backed, it will require something like a traditional bank. This makes it extremely easy to shut down (ironically, since Taleb sees this drawback in Bitcoin, see “Fallacy of safe haven”), as it is a central point of failure. If Talebcoin is instead crypto-backed or seigniorage-based, Talebcoin becomes even more technically complex, and it still likely requires a central committee to decide on the basket of goods and services, i.e. a central bank is still needed. In addition to this committee being a dangerous single point of failure (the committee wields enormous power), it is also unclear if the decisions of this committee will be perceived as fair and sufficiently useful to be preferable over another scheme, such as USD, or Bitcoin.

We need to further consider the question of the desirability of the Talebcoin scheme. Taleb proposes Talebcoin because he believes that Bitcoin has no chance of success as a currency. Yet as I have explained above, he does not make a good case for this. Furthermore, we don’t know of ALL the ways a currency can come about. The fact that no currency like Bitcoin has come about yet is a natural consequence of Bitcoin being the first of its kind. Taleb says that what is needed for Bitcoin to become a currency is low enough volatility:

“All this [Bitcoin being a currency] requires a parity in bitcoin-USD of low enough volatility to be tolerable and for variations to remain inconsequential.”

This could certainly become true for Bitcoin: the volatility of Bitcoin could at some point drop sufficiently that its benefits (e.g. disinflation in monetary terms, hard to confiscate) outweigh the drawback of high (but diminishing) volatility.

Another question as to the desirability of Talebcoin is the statement that competition between fiat currencies provides a convenient monetary store of value:

“This competition [between fiat currencies] provides for a vastly more convenient monetary store of value. For practitioners of quant finance, the most effective inflation hedge can be a combination of bets which includes short positions in government bonds.”

Competing fiat currencies does not seem like a good store of value to me, because all of them are (or have been) inflationary: The Deutsche Mark, the Swiss Franc, etc. Talebcoin, too, would be inflationary, when compared to Bitcoin. I am also not impressed with Taleb’s argument in favor of his currency proposal because of quantitative finance arguments, which does little to help the vast majority of people who do not practice quantitative finance.

A final point should be made: A free market economy already has an incredibly efficient and decentralized mechanism in place to adjust prices depending on the supply (of goods and services) and demand (in terms of the quantity of money, whether it be USD, Talebcoin, or Bitcoin). Why not rely on this very robust mechanism, instead of proposing something very fragile (Talebcoin) which does the reverse, namely centrally adjusting the money supply in the hope of tracking a basket of goods and services fairly?

Talebcoin is unfortunately not specified. Yet, compared to Bitcoin, it must be more complex, both technically and from an agency point of view (and it might prove to be not feasible at all). Therefore, it must be more centralized and more fragile than Bitcoin. Finally, it is not even clear if Talebcoin users would prefer it over competing schemes. It is still inflationary, just perhaps less so than the USD.

Talebcoin therefore achieves the reverse of what is what set out to do:

I do not mean to discourage an attempt to create something like Talebcoin, I merely state that it is likely to be more fragile than Bitcoin, and not as useful as Taleb suggests, thereby partially defeating the reasons why it should be created in the first place.

Taleb’s conclusion consists mainly of this statement:

“We have presented the attributes of the blockchain in general and bitcoin in particular. Few assets in financial history have been more fragile than bitcoin.”

As I have shown above, Taleb did not manage to make a theoretical case that Bitcoin is fragile. His arguments are either wrong or unconvincing. Furthermore, his conclusion that Bitcoin is fragile is incompatible with the empirically observed fact that Bitcoin has been gaining in strength over its entire life according to all relevant metrics: increasing price, number of nodes and participants, development of new features and infrastructure, growth in the lightning network…

In his book “Antifragile”, Taleb makes the case that some of the things that are the least fragile have components that are very fragile: Humankind (more robust than a single human) consists of humans, each of which is fragile. The human body (more robust than a single cell) consists of cells, each of which is fragile. In some cases one can achieve robustness or anti-fragility by allowing for fragility in some components. The same argument can be made of Bitcoin: Bitcoin is very robust, in part due to its flexibility in its underlying principles. The hashrate can swing wildly, with little noticeable effect on the operation of the network. Nodes can go offline again with no noticeable effect. An argument can be made that large contrasts in public discourse (some very optimistic, others - such as Taleb - very pessimistic), and price volatility are also good for Bitcoin overall. Overly optimistic public discourse about Bitcoin, or a rapidly increasing price attracts trend followers to Bitcoin, whereas a strongly negative discourse or a price crash can attract contrarians to Bitcoin. These anti-fragility arguments can be made for Bitcoin and other trust-minimized systems, but not for Taleb’s proposal for a digital currency that would likely have very centralized decision-making, and therefore be extremely fragile.

Taleb’s black paper suffers from many of weaknesses. He uses a discounted cash flow model to show that Bitcoin is in trouble. If he used the same methodology for gold, he would arrive at the same (or worse) conclusion for gold. He concludes that exponential growth at a rate above the discount rate (which can be chosen arbitrarily) is impossible (in spite of counter-examples existing). He spends a lot of effort insisting that gold and Bitcoin are fundamentally different in terms of an absorbing barrier, yet fails to make a convincing case for that statement (he even makes a few factually incorrect statements and ignores possible counter-arguments). Yet in the end, the supposed absorbing barrier has virtually no effect on the DCF model. He repeats the tired old argument that Bitcoin is slow, expensive, and cannot scale to become a real currency. This argument might have been believable five years ago, but not anymore. I therefore found nothing in the black paper that would sway my opinion that Bitcoin is becoming ever stronger.

Taleb makes four statements concerning Bitcoin in the black paper: Bitcoin is worth 0, it is not a currency, not an inflation hedge, and not a safe haven. He also recommends a scheme for a currency without government which I have named Talebcoin. My biggest disagreement is concerning Taleb’s statement that Bitcoin is headed towards 0. In my view, Bitcoin is gaining strength over time, and it becomes ever less likely that Bitcoin will hit 0. The other points are less certain: Is volatility going to become low enough that Bitcoin will be used as a numeraire and a true currency? I can imagine scenarios where the answer to this question plays out in the affirmative or the negative, yet Bitcoin is tremendously successful in both. Concerning Talebcoin, I don’t see anything fundamentally repulsive about the scheme, but it is very vague, and likely any implementation of the idea would be much more fragile than Bitcoin, thereby at least partially defeating the purpose of implementing it in the first place.

Taleb specializes in risk analysis, specifically “tail” risks: risks that are catastrophically large, or that have the potential to become catastrophically large due to multiplicative effects. Bitcoin being a novel phenomenon, and indeed not tied to the real world via something like a dividend payout, we can concede that it is inherently risky. Someone investing large parts of his net worth into Bitcoin is therefore indeed putting himself in a position of large risk, even if total ruin is unlikely in my view (unless a leveraged position is used). However, the person investing in Bitcoin is putting only himself at risk, not other people (with the exception of his family). Bitcoin would therefore appear to not be a multiplicative risk. The risk stays with those that were willing to take on the risks. We could therefore argue: So what’s the big deal, why should we worry about this risk? Does Taleb actually mean to say that Bitcoin poses risks for the wider society? If so, he should elaborate.

Furthermore: to what extent is risk-aversion worth it? Staying away from risky assets indeed removes the risk of losing money on that investment, but it also comes with the potential opportunity cost of having missed out on a potentially spectacular investment. If decades from now Bitcoin is incredibly successful and valuable, how should we judge Taleb’s black paper? Should he be lauded for recommending to avoid the risk? Or should he be criticized for not having recognized the amazing opportunity that Bitcoin was in 2021?

Advising people to stay away from all risks is too easy. At least, Taleb should be willing to demonstrate that he is confident in his own forecast that Bitcoin is headed to 0, and is willing to risk some money on it. We could advise him to try to short Bitcoin (which can be done easily via futures contracts), however this might be very difficult to execute. He might lose on the short trade yet still be ultimately proven correct. The reason for this is that Bitcoin is not expected (not even by Taleb) to follow a steady path towards 0. It could reach any price before then, including a much higher price than the current one. Taleb explains this in a series of tweets that were published well before the black paper. What would be needed instead is a way to bet that Bitcoin is going to reach a value of 0 independently of the prices reached in between now and that absorbing barrier. An ending date is still needed, otherwise the bet might never end (if Bitcoin stubbornly keeps a positive price). I suggest that 10 years is a reasonable time horizon: It is sufficiently long for Taleb’s prophecy to play out, yet also reasonably short to still make the bet interesting. I offer Taleb exactly such an opportunity to signal confidence in his prediction: I have created such a bet on longbets.org, and cordially invite Taleb to challenge me. The bet reads:

“Ten years from now, on September 15th, 2031, one bitcoin will be worth more than 0.05 troy ounces of gold.”

I am using gold as a natural measuring rod for Bitcoin because Taleb specifically compares Bitcoin to gold, with gold supposedly having staying power, and Bitcoin not. I am predicting that Bitcoin will have a value of (at least) the equivalent of approximately $80, because this value can be considered both high enough to be non-negligible (Bitcoin reached this price only in its fifth year of existence), and low enough to represent a good threshold for failure. The price of Bitcoin in terms of troy ounces of gold can be tracked under the ticker BTCXAU.